Key Differences Between Experian and Equifax

Aug 17, 2022 By Triston Martin

The three major credit reporting agencies in the US are Experian, Equifax, and TransUnion. These agencies, called credit bureaus, collect credit data from lenders and creditors to inform their decisions about the borrower's creditworthiness. Both Experian and Equifax deal with credit reports from individuals and businesses in the US and abroad.

Understanding Credit Bureaus

All credit bureaus are required by law to provide their clients with at least one annual free credit report. Data is vital in this business; there is no room for incorrect, incomplete, or outdated information. Therefore, all credit reporting agencies have to take it upon themselves to continuously and consistently update their data and analytic tools.

Another vital issue is data protection. Clients' data should not be shared with anyone else without express permission by the client, who acts as the sole owner of any information that regards them. Cyber-security breaches, such as the one that affected Equifax in September 2017, may have adverse effects on the bureau. Consumers may not trust the bureau anymore and may choose to select another. Also, the bureau may land into civil trouble with the courts.

Credit bureaus need to be transparent, objective, and act legally.

Experian

Experian serves over 1 billion individuals and businesses globally. It was founded 26 years ago and has branches in Dublin (Ireland), California (US), Hamburg (Germany), Sao Paulo (Brazil), and Singapore.

Experian provides the following services to its clients:

- Decision analytics.

- Credit reporting.

- Fraud prevention.

- Marketing services.

Equifax

Equifax's headquarters in Atlanta, Georgia, serves over 800 million individuals and 88 million businesses globally. It constitutes the 'Big Three' of credit bureaus, alongside Experian and TransUnion.

Equifax provides the following services to its clients:

- Collection of credit data.

- Credit tracking.

- Fraud detection, prevention, and mitigation.

- Credit reports to businesses, individuals, and government agencies, among others.

Key differences between Experian and Equifax

Credit Score Reports

It is not surprising to have your credit score as 630 with Experian and 540 with Equifax or vice versa. The difference could be so gaping that you lie on the 'good' scale from one bureau while you're at the 'poor' level on the other. Yet you provided the exact information to both agencies. No need to fret; the reasons are entirely reasonable.

Different Scales

One, the two bureaus use different scales. Inasmuch as they both use the FICO system, the scale is where the disparity lies. For Experian, the scale is between 0 and 1000, where the bands are:

800-1000 – Excellent

700-799 – Very Good

625-699 – Average

550-624 – Fair

0-549 – Low

Whereas for Equifax, the scale is:

853-1200 – Excellent

735-852 – Very Good

661-734 – Average

460-660 – Fair

0-459 – Low

The difference is clear. A credit score of 500 is considered low for Experian but fair for Equifax. Assuming the mortgage, you are applying for requires a minimum credit score of 500 but uses Experian for its credit reporting. Seeing that it is a bit too low on the scale may mean the mortgage company may deny you the offer in favor of a higher score. However, it does not always work this way. The illustration highlighted the difference in credit score reporting from both Experian and Equifax.

Conversely, having a credit score of 800 sets you at 'Excellent' by Experian and 'Very Good' by Equifax. Both are high scores and will provide you with the benefit of receiving higher loan limits and lower interests.

Different Expositions

Data is fluid; what one party does with a piece of data may be completely different from what another party does with the same data. This vital piece of information should be upheld when comparing Experian and Equifax.

The following table shows which information is available on both credit reports:

Data | Experian | Equifax |

Personal Information | Past addresses, credit infringements, past credit inquiries | Address history, inquiries from potential creditors, client statements |

Installment loans | Car loans, personal loans | Car loans, personal loans |

Public records | Bankruptcy records five years from the listing date | Bankruptcy declarations |

Accounts | Credit cards and mortgages | Revolving accounts |

Different Preferences

Different creditors will select different credit bureaus for their data. One may choose Experian, while the other chooses Equifax. The issue here is which bureau you select and at what time. Time is a crucial factor in assessing creditworthiness.

Regarding your bureau of choice, one may have data that encompasses fewer factors than the other. For instance, though Experian is considered more mainstream and universal, analysts believe Equifax considers more information than Experian in producing credit reports.

Also, some debts may be reported in one bureau and not the other, which automatically means that your score will be lower in one and higher in the other.

Performing Credit Searches

Experian tends to be more thorough when keeping track of recent credit searches than Equifax. Since Experian provides monthly balances for each account, its data must be continuously updated, which means that the credit searches it undertakes are refreshed and timely.

Equifax makes it easier for users of their data to understand whether data is old or new by creating a module that outputs data as either 'open' or 'closed.'

Monitoring Credit Reports

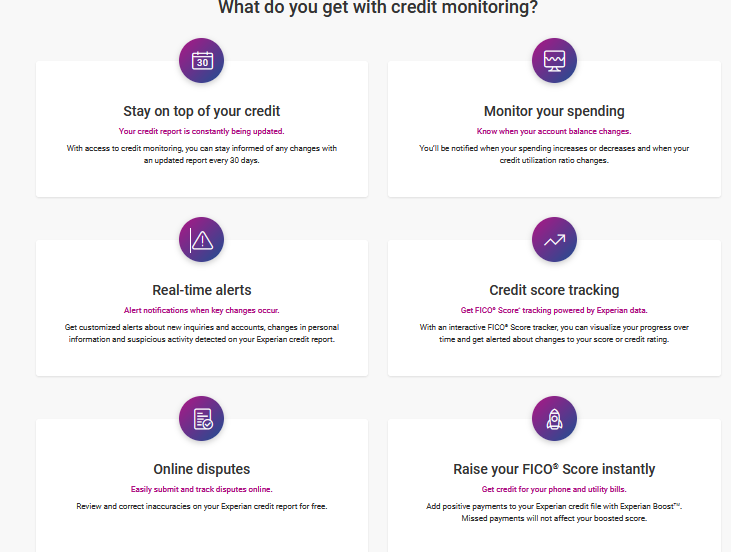

Both credit bureaus allow for new credit inquiries and new accounts.

For Experian, you get free credit monitoring without signing in with your credit card.

For Equifax, credit monitoring starts at $4.95 monthly, with any-time cancellations allowed.

Credit monitoring is essential in detecting any signs of fraudulent activity on your accounts. Both Experian and Equifax send you alerts when they notice any suspicious changes. They help you stay on top of your finance game, so you can track each transaction you have undertaken and on your credit.

Always settle for credit reports from both credit reporting bureaus when in doubt. Having a witness or a second opinion is better and more accurate than relying on one. In fact, it is perfectly fine to use all three credit bureaus to get a more nuanced picture of your credit history and utilization. Most employers and government agencies who need credit reports to make serious decisions opt to confirm Equifax's report with Experian or Experian's report with Equifax.