Beginners Guide for Bad Credit Performance Bonds

Dec 03, 2021 By Susan Kelly

Performance bonds are available from a variety of financial institutions and insurance companies, and they are designed to ensure that contractors fulfill their obligations and complete projects on time and within budget. The two industries in which it is most commonly employed are real estate development and construction, to name a couple. Construction company owners must obtain a performance bond in order to ensure that the project is completed on time and within budget. An additional financial assurance measure in the event of a project outcome that is not satisfactory, such as when the principal fails to meet his or her contractual obligations, performance bonds are used to protect investors.

Performance bonds

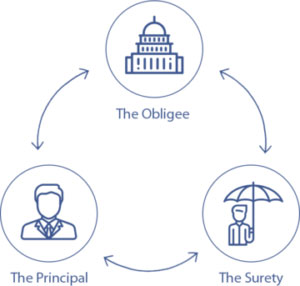

There must be a performance bond issued by all three parties involved in the contract in order for it to be executed. An applicable bond, which is a type of confirmation bond, consists of three parties:

- Bondholder

- Surety

- Obligee (the party who is being held accountable)

A "surety" is someone who, in exchange for a fee, guarantees the performance or fulfillment of a party's obligations to another (the oblige). In the construction industry, performance bonds serve as an assurance that a contractor will complete a project on time and within a comfortable budget. A claim against a bond can be filed by the oblige if the contractor fails to meet the agreed-upon specifications.

What is a Bad Credit Performance bond?

If you have a bad credit performance bond, it means that you are at risk of paying back any claims made against you if you fail to live up to the terms of the contract.

Relationship bad credit and risk associated with it

You must have a good credit history and a high credit score in order to be approved by a surety agency for a construction project performance bond. When a principal fail to comply with the terms of a performance bond, surety companies assume the responsibility of compensating the financial losses suffered by the performance bondholder. They need to know whether they will be reimbursed by the principal because the surety company spent money to cover claims on their behalf.

As a result, surety bond firms are justified in running a credit check on you before issuing you a performance bond. For the underwriters, the most important consideration is whether or not you can be relied on to pay any claims made against the performance bond. You can now determine whether or not you will be able to meet your financial obligations under the performance bond by evaluating your credit score and financial situation. Upon completing an evaluation, underwriters either offer or deny the bond to the principal based on his or her credit score and history.

It will be easier to obtain the performance bond and at a lower premium rate if you have a good track record of debt repayment. In the event that your credit card debts are excessive and you have recently filed for bankruptcy, you are more likely to be rejected by traditional sureties. They believe you're a high-risk borrower with a low repayment rate, so they refuse to lend to you.

Can you get performance bonds with bad credit?

Yes, contrary to popular belief, instead of low credit scores and other financial issues, you can get performance bonds. Many companies, but not all, provide this service. There are unique programs available for persons with poor credit at Bonding Solutions. In the event that one surety company rejects your application for a performance bond, you can approach towards high-risk surety bond businesses like Bonding Solutions for assistance.

Specialty and regular sureties are supported in today's market. The latter is more accommodating than former, which has stringent guidelines and would not accept applicants with poor credit histories. While improving your credit score will require extra effort, high-risk surety bond companies provide various tools and programs to help you.

Financial statements for the year

Investment strategies are discussed here

Cost-control instruments are available

Cash flow as a whole

The total value of all non-financial &' financial assets

Amount of money available for working capital

Credit relationships are important

Previous project performance and the monetary value of the ventures

Equipment and tools are needed

Team

Plan of work and management

Commodities

Lenders

Approval of your application is guaranteed if underwriters determine that you meet all of these requirements. However, each industry has its set of rules.

Ways to obtain Performance Bonds with Bad Credit

Your business should not be abandoned because of poor credit. Performance bonds can be obtained even if you have poor credit. If you do not have good credit, there are numerous ways to get performance bonds. You also have other options for dealing with the problems and completing the projects you want to do. Performance bonds can be difficult to obtain, but it's doable with the help of professionals who can make the process easier. Bonding Solutions assists contractors with poor credit histories in obtaining a performance bond, allowing them to proceed on their projects with confidence. Some of the most popular options are listed below:

The SBA's Bond Guarantee Program

The SBA's Surety Bond Guarantee Program is designed to assist small businesses in securing contracts. Surety companies can rely on collateral guarantees from the SBA programs if their principals are unable to get regular approvals.

Fund Control

This is a tool for managing the cash flow of the bonded project by contractors. In order to secure a bond, the principal must guarantee that the project will be adequately funded.

Collateral

Principals with poor credit can also turn to collateral as an alternative. A credit rating from the bank or cash might be used as collateral to safeguard the principals against any bond losses.

Joint Venture

Assuming both parties have good credit, the two contractors form a joint venture. For both individuals, it is a win-win situation that encourages surety companies to issue bonds.

Cosigner

Small contractors may also choose a consigner, a someone who promises to repay the loan on behalf of the small contractor. Low-payment bonds are often recommended by us when they are necessary.